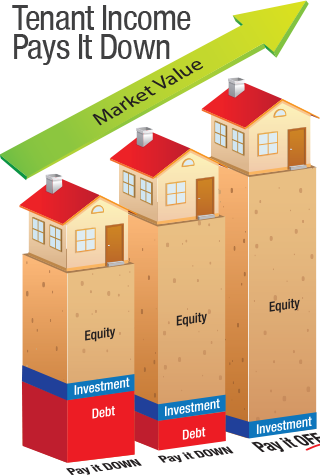

When monthly rental income covers your monthly property expenses - including mortgage payment - this is where the magic happens! Month after month, someone gives you money to pay down your debt and increase your net worth!

Banks are willing to help us buy real estate worth much more than the down payment.

(ie. with a 20% down payment of $50,000 you can buy a property worth $250,000)

Refinancing your home or rental property can also provide a form of leverage that enables you to buy with little or no money. Ask us how!

While there's no crystal ball, with few exceptions, the market value of real estate in Canada has consistently risen year over year. Property owners don't need to do anything special to receive this nice annual bonus!

When your rental income covers more than your monthly expenses on the property, the left-overs are gravy!

Point to consider: Imagine having 1, 3, 5 or more properties completely paid for (no mortgage owing) so that a large portion of those rent cheques go directly into your pocket every month.

Real estate investing is a business with many tax advantages. As an example, the expenses related to your investment property are tax deductible (legal fees from closing, insurance costs, mortgage interest, etc.). An accountant well-versed in real estate investing can help you with this.